Clueless about personal finance forms?

You’re not alone. Thousands, if not millions, don’t know what these forms are and what they’re for. Thus, their personal finance management suffers because they can get their tax payments wrong. So we’re bringing you information about these forms. We’ll discuss what these forms are for, and how to fill them out correctly.

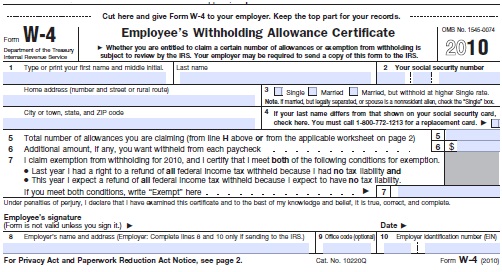

Form W4

This form is also known as the Employee’s Withholding Allowance Certificate. The W4 is a helpful document that informs your employer your withholding allowance claims. This form requires you to divulge information like marital status. It also tells the employer if you are claiming exemptions from withholding.

How to Fill Out the W4

- To fill out this form properly, read all the instructions first. On the Personal Allowances Worksheet part are lines A to H. These lines let you determine your personal allowances. If you’re married, you need to also include your spouse’s allowances in this section.

- For those with children, they need to follow the instructions starting from line D to determine their allowances. And Line H asks you to sum everything up.

- The bottom part of the form is the Employee’s Withholding Allowance Certificate. You’ll be asked to fill your personal information along with the total personal allowance amount. Through this certificate, you can ask your employer to take out an additional amount from your monthly paycheck (you can do this on Line 6). For Line 7, this is applicable for those who were tax exempt the previous year.

1040, 1040A and 1040EZ Form

1040 is the form used to file income tax returns. This form has a lot of sections where individuals disclose their financial income for the year. The IRS will then use this form to decide whether the taxpayer is short on his taxes or is due for a tax refund. All 1040 forms must be filed before April 15.

The 1040A is a simplified version of the 1040 and is used by taxpayers who earn less than $50,000 a year and who do not own businesses. The 1040EZ is the income tax return form for taxpayers without dependents.

How to Fill Out the 1040EZ

For the purpose of simplifying this article, we will only feature the hardest of the three forms—the 1040.

- Fill in your personal information. Make sure all information you provide is current. Don’t miss out on filling out your Social Security information as this can lead to delays or can increase your tax.

- Check your correct status on lines 1-5 (either single, married filing jointly, married filing separately, head of household, or qualified widow or widower).

- Complete exemptions section by checking the appropriate box. Determine if your dependents are qualified for child tax credit. Add up all the numbers once done.

- Complete the income section by checking line 7 of your W2. Add up everything to get your total.

- Complete the adjusted gross income, if applicable.

- Come up with your deductions. For this part, you can either itemize your deductions or just use the standard deduction from your status.

- Calculate your taxable income for you to determine your tax. Also determine which credits you can apply.

- Next, complete the Other Taxes section, if applicable.

- Last, fill out the payments section.

Now you’re not so clueless about these finance forms. It’s best to ask help from an accountant. However, you can go ahead and file your own taxes if you’re confident you can do it on your own. This article about personal finance form should give you a headstart.